XM is a well known online trading broker owned by Trading Point Holding, an international CFD and foreign exchange broker that was established in 2009. XM has more than 3,000,000 active users from all over the world.

XM Regulations

XM is an international broker that is regulated and supervised by three financial regulations,

- The Cyprus Securities and Exchange Commission (CySEC)

- The Australian Securities and Investments Commission (ASIC)

- The International Financial Services Commission of Belize (IFSC).

- MENA Limited, XM legal division, regulated and supervised by (DFSA) the Dubai Financial Services.

XM Pros and Cons

While XM is one of the most reputable brokers in the world and especially in Asia, offering low spreads and fees, Easy account opening, a huge variety of educational tools and demo accounts, it also has some cons. Let’s see XM Pros and Cons:

XM Pros

- Low Withdrawl fees

- Easy Account Opening

- Great Variety of Educational Tools

- One of the most reputable forex brokers in the world

- Seminars & Webinars

XM Cons

- Limited Financial Instruments and assets

- No protection for non-EU clients

- Not accepting US clients

- Inactivity fees

In this detailed XM review, the ElitesFX team covers some of the most important aspects for you to consider when thinking of choosing XM as your prefered Forex Broker to trade with.

Why Choose XM?

XM is based in Cyprus but has a presence in Greece, Australia and Belize. Furthermore, they have local offices and teams in most Asian countries such as Thailand, Vietnam, Bangkok, Japan, Indonesia, Malaysia etc. They employ about 500 employees that are trained to the higher industry standards in order to meet their clients’ expectations in execution, support, education and User Experience.

Trading with XM is very pleasant as the broker offers a lot of secure deposit payment solutions. In fact, they have 25+ payment methods depending on the country that you are depositing from. XM offers some industry-leading trading platforms including the MT4, MT5 and their own platform which is available to access both from Desktop and smartphone devices.

Given the fact that XM is strongly regulated, they offer the same quality of service to beginner, intermediate and advanced traders regardless of their investment size or their experience.

Opening XM Trading Account

XM is an international broker, so you can easily open a trading account with them wherever you are, except for these countries: Israel, Japan, the United States of America, China, Canada and New Zealand. You can open your account with XM easily, with a minimum of only $5 for one category of accounts, and a minimum of $100 for another category of accounts. A minimum of $50 for the last category of accounts. You can view them as shown in the picture. You will also notice the variety of account types with XM.

With XM it is very easy when it comes to opening a trading account. In just a few minutes, you can finish entering your personal data and the account is verified to start trading directly. The form is available in multiple languages as XM is an international broker. Swap – free account, In the interest of XM and other trading brokers to preserve the religious beliefs of all. It provides Islamic or interest-free accounts. Compliant with Islamic rules.

With these Islamic accounts, the company charges a fixed commission as long as you maintain your leverage overnight. Here we come to the steps to open a real account with XM – with pictures

- Basic data ” Full name – country – email – phone number – address – date of birth.

- Choose an account type and trading platform.

- Determine the base currencies.

- Leverage size.

- Some questions regarding your level of trading experience.

- Verify your identity.

Deposit & Withdraw & Fees

XM offers a $0 deposit fee. Deposit methods are possible via bank transfer or credit / debit cards. By bank transfer, the process may take several days. With the bank card, the process takes place instantly. XM also offers a $0 withdrawal fee. But in the case that bank transfer is used as a withdrawal method, an amount of $15 will be deducted. Withdrawal process only takes 2 business days.

Note that in the process of withdrawing, you must withdraw a value equal to the amount that you deposited with the credit / debit cards. But if you want to withdraw a higher value, the only solution is a bank transfer. XM Fees, The question that always comes first, which to some extent favors one broker over the others. What are the brokers’ fees?

You should distinguish between two types of fees, the first being the fees for opening and closing deals & trades, which are represented in the spread, and the swap – free in Islamic accounts. The second is the fees related to withdrawals and deposits and also for inactivity of the account for a period of time.

Now, the vision has become clearer for you, and you can read the broker’s fees better and understand all of its details. Let’s start with the trading fees we mentioned in the first category, which includes opening and closing the trade. And you should think about it in both directions when opening and closing the position. XM comes as a competitive broker in these fees, as through its accounts, we focus here on the common account, which is the standard account.

Spread with XM

- Micro Account

- Standard Account

- XM Ultra Low Account

- Shares Account

- XM Zero

The cost on the EUR / USD currency pair is 1.7 pips “Standard Account”, however the cost drops to 0.8 pips with an XM 0 “ECN Account”. Given that the broker XM sets the minimum to open an account is only $5, meaning that these fees for the size of relatively small accounts meaning less than $1000, for example, are competitive prices.

If you are thinking of investing a larger amount than that, you will think of other solutions, whether by choosing the type of ECN account with XM, or by comparing the company with other brokers in the industry to serve your investment goal in the end. With this we may have covered the first class of fees for opening and closing trades and their costs for you. Let’s now move to the second category of fees that we mentioned above.

Islamic accounts and overnight swaps. The matter here is usually a net fee applied on a daily basis to trading operations. In theory, these fees go back to the next day that is applied in banks. Most brokers sometimes offer inappropriate prices that make trading costly. But with XM, their fees are due to the bank market’s next rates next with their margin & commission added for sure. Therefore, XM in this category of fees is also competitive for investors & traders who open trades and hold them for periods of time up to two days, for example.

The final part that we will talk about here regarding the fees of brokers and especially the broker we are talking about in this article “XM”. Fees for withdrawals and deposits. XM charges inactive accounts $ 5 a month after a 90-day of inactivity. XM offers a free deposit and withdrawal service without any charge, except in the case of funds less than $200 with a bank transfer. This fee makes great sense for most traders. Especially compared to other brokers in the industry, XM is very competitive at this point with its versatility and ease of payment.

Therefore, we can now get out of these details thus, XM offers competitive fees for traders and accounts less than $1000. In addition, the XM Zero account is suitable for all types of deposits.

XM User Experience

XM is one of the strongest brokers in the world in the degree of client preservation and always providing the best in a way that ensures strengthening the continuation of the client with them and attracting new clients. They offer some industry-leading trading platforms, educational resources, trading tools and other features that set them apart from their competition. Let’s see them as a part of our XM review:

XM Trading Platforms

XM Groups allows traders to choose along some of the most popular Trading Platforms including MetaTrader 4 (Desktop and Smartphone) , MetaTrader 5 (Desktop and Smartphone) and Web Trading. Allowing their users to trade directly from their phones is very convenient as they can access their trading account from anywhere as long as they have an internet connection.

XM – MetaTrader 4 (MT4)

MetaTrader 4 (MT4) is a user-friendly trading platform that is sought-after by all types and levels of forex traders. Due to the extremely user-friendly design, you can have a great experience trading without worrying about tricky navigation or confusing menus! MT4 come prepacked with a lot of free tools and you can also integrate 3rd party tools such as forex signals. The flexibility in tool integrations and the prepacked tools will allow you to conduct detailed analysis and improve your trades with over 100 indicators!

XM Group offers a lot of educational videos that you can watch in order to help you learn trade execution on MT4 but also improve your trading strategies.

XM MT4 Features:

- Over 1000 Instruments Including Forex, CFDs and Futures

- Expert Advisors and built-in and custom indicators

- The ability for 1-Click Trading

- Technical analysis with over 50 indicators and charting tools

- Help guides and Tutorials for MetaTrader 4 and MetaQuotes Language 4

- Handles a vast number of orders

- Creates various custom indicators and different time periods

- History database management, and historic data export/import

- Guarantees full data back-up and security

- Internal mailing system

- Hedging allowed

- VPS Functionality

- Micro Lot Accounts (Optional)

- 3 Chart Types

XM – MetaTrader 5 (MT5)

The XM MT5 offers all features that XM MT4 offers along with the ability to trade thousands of CFDs on Stocks (shares). Using the XM MT5 you can trade forex and CFDs on stocks, gold, oil and equity indices from 1 platform without rejection or re-quotes for leverage up to 30:1!

XM MT5 Features:

- XM MT5 over 1000 instruments at your disposal. From the Stock markets, to Forex and precious metals we have all of your needs covered!

- Access all 7 platforms with a single login

- Ultra-low spreads! As low as 0 pips

- Full Expert Advisor Functionality

- One-Click Trading

- All Order Types Supported

- Hedging Allowed on XM MT5

- Multi-asset platform for over 1000 instruments

- Ability to display 100 charts simultaneously

- Supports all order types. Some of them are market, pending, stop orders, and trailing stop

- Over 80 Technical Indicators and over 40 Analytical Objects

- Superior built-in MQL5 development environment

- Mobile trading for Android & IOS

- Web trading for Windows, Mac, Linux operating systems

- Internal mailing system

- Multi-currency tester and alerts

XM Trading Tools

As a part of our XM review, we analyzed the Trading Tools that XM provides to its traders. It seems like XM group offers a huge selection of proprietary trading tools for both MT4 and MT5. The tools that XM Group offers can be fully automated and help you perform quick technical analysis for all financial instruments and charts. The trading tools allow traders to quickly identify trading opportunities, signals and potentially successful trades without spending a lot of time on analyzing charts.

Some of the Trading tools that XM offers for MT4 & MT5 are:

Ribbon Indicator

The Ribbon Indicator is fully customizable, which allows you to use your own colors or choose from one of our pre-selected color schemes. You can also set how many candlesticks are displayed on each ribbon for an even better view of the chart! The Ribbon Indicator can help you with:

- Helps you follow the prevailing trend

- Identify areas of consolidation

- Predict impending reversals

- Know the most suitable time to trade

River Indicator

The River Indicator is a great tool for helping identify potential reversals in the market and it can help you make more profitable decisions. You’re going to love this! The River Indicator can help you with:

- All-in-one trend indicator

- Know which markets are trending

- Identify strength and direction

- Learn how the market is moving

Ichimoku Indicator

- Identify support and resistance levels

- Recognise strong market trends

- Know when is best to enter a trend

- Learn where prices might go next

Bollinger Bands Indicator

- Learn to trade market volatility

- Identify entry points in ranging markets

- Recognise extreme price levels

- Know when price movements will occur

ADX & PSAR Indicator

- Recognise a market in consolidation

- Identify the start of new trends

- Learn the best time to place a trade

- Know when trends reach extreme conditions

Analyser Indicator

- Analyse in a fraction of the time that it would normally take you

- Map the market direction in real-time

- Quickly identify the best instruments to trade-in

How to Get access to XM Trading Tools

In order to get access to the great trading tools that XM offers, you will need to first open an account with them. Once you open your account with XM, you will receive the contact details of your account manager. What you will have to do next, is to contact your account manager and request access to the Exclusive Technical Indicators!

XM Trading Calculators

XM’s online calculators allow traders to make wise assessments at the right time to make the most out of their trades. XM offers the following trading calculators:

- All-in-one calculator

- Currency converter

- Pip value calculator

- Margin calculator

- Swaps calculator

- Profit and Loss Calculator

All of the above calculators are available to help you evaluate your risk and monitor profit or loss for each trade you carry out.

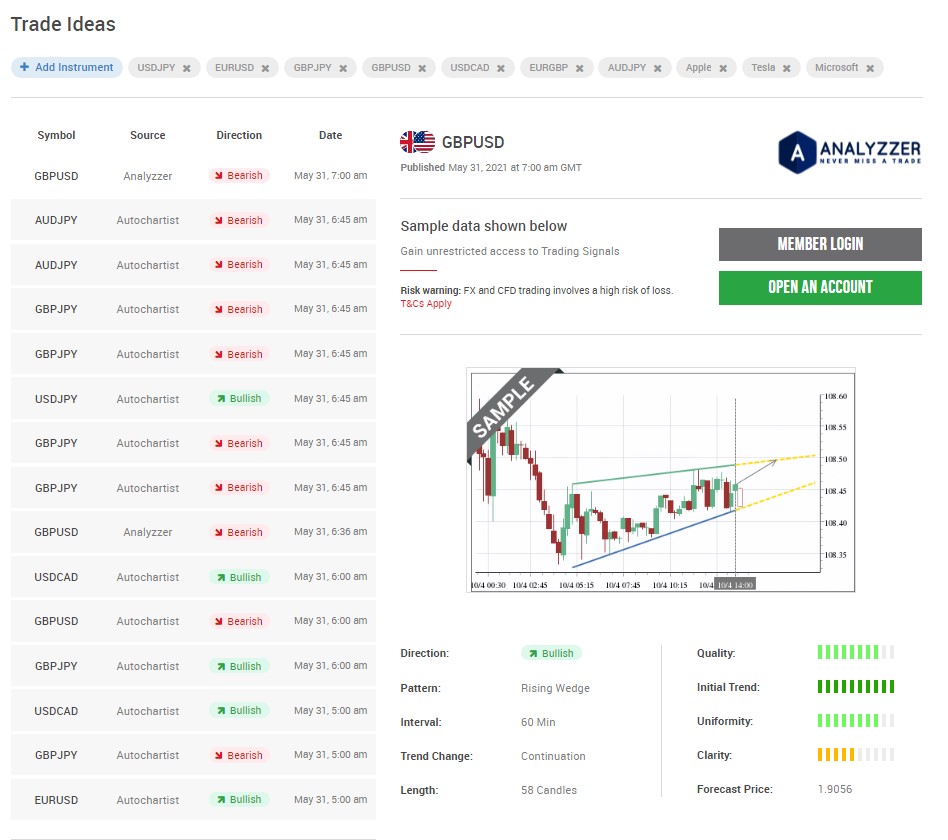

Trade Ideas by Autochartist and Analyzzer

Autochartist – Autochartist can help you save valuable time when analyzing charts! Autochartist scans a variety of trading instruments in real-time and identifies technical Chart patterns and Fibonacci patterns to help you identify trading opportunities.

Analyzzer – ANALYZZER is an automated mechanical algorithm that uses the latest in artificial intelligence and machine learning to identify proprietary price patterns and provides signals on trading ideas in Forex, Equity Indices and Commodities that have an accuracy of up to 83%.

XM VPS – Virtual Private Server for Trading

Using the XM VPS, you connect remotely to a Virtual Private Server (VPS) that is located just 1.5km away from XM’s data center in London. The connection is done through optical fiber and therefore, it is considered one of the fastest ways to connect to the market and execute trades rapidly.

XM traders are using the XM VPS to ensure that they make the most of the unparalleled execution of XM, without having to worry about external factors when it comes to trade execution. It also allows you to run the MT4 or MT5 trading platform 24h without having to keep your PC switched on.

Why should you use XM VPS:

- Increase the Speed of your Trades

- Enjoy Optical Fibre Connectivity

- Accessible from any Location

- Online 24 / 7

- Ideal For EAs

- State of the Art Hardware

How to get access to XM VPS

In order to be able to get access to the XM VPS service, you will need to maintain an account balance of 5000USD (or equivalent in other currencies). If you meet this criterion, you will be able to request it from the Members Area at any time on the condition that you trade at least 5 standard round turn lots or 500 micro round turn lots per month.

In the case that you do not meet the criteria mentioned above, you can still get access to the XM VPS service on a $28 per month fee. The fee is automatically deducted from your MT4/MT5 accounts on the first day of each calendar month.

Connecting to the VPS is straightforward and can be done in 4 easy steps:

STEP 1

Click on your PC’s “start” button and type “Remote Desktop Connection” in the search box . Once you see the result click on the option for remote desktop connection.

STEP 2

From the Remote Desktop Connection window type in the XM VPS IP address that you have been provided with and click the “Connect” button.

STEP 3

Enter your login credentials (username and password).

STEP 4

Accept the security prompt (There is no need to worry about the standard warnings)

XM Education

Traders need to stay on top of the financial market. They are always looking for new ways to get information and make money off of that information. XM Education provides traders what the need in order to be successful in trading. If you are interested in staying up-to-date with the market you should be reading XM’s education section daily!

XM offers a vast range of educational material including:

- Daily Market Updates

- Trading Signals

- Economic Events

- Videos

- Tutorials

- Webinars

- Seminars

- Economic Calendar

- Financial Market News

- Trade Ideas

- Technical Summaries

- Podcast

- XM Live

- Live Education

- Platform Tutorials

- etc

The XM Education section is available to all XM’s clients to use and it provides access to valuable data that can help you level up your trading strategies. The education section is offered in more than 20 languages and you can find material on anything that you may need to learn.

Markets Overview

The Markets Overview gives traders access to the Lated Headlines, XM TV, Latest Research, Newsfeed and Trade Ideas. Pretty much, it’s a quick dashboard to get a grasp over the daily or weekly data that you can use in order to perform fundamental Analysis or Technical Analysis for your trades.

Latest News

XM’s Latest news highlights the most important worldwide news that is expected to affect currency pair prices. You get the news straight from Reuters and you have the option to listen to the article in case that you don’t want to spend time reading it.

XM Research

The XM Research section is managed by market expert professionals and provides live daily updates on all the major events of the global markets in the form of market reviews, forex news, technical analysis, investment topics, daily outlook and daily videos.

Trade Ideas

XM Trade Ideas is powered by Autochartist and Analyzzer and gives traders insights on various Currency pairs, Stocks, Metals, Energies etc.

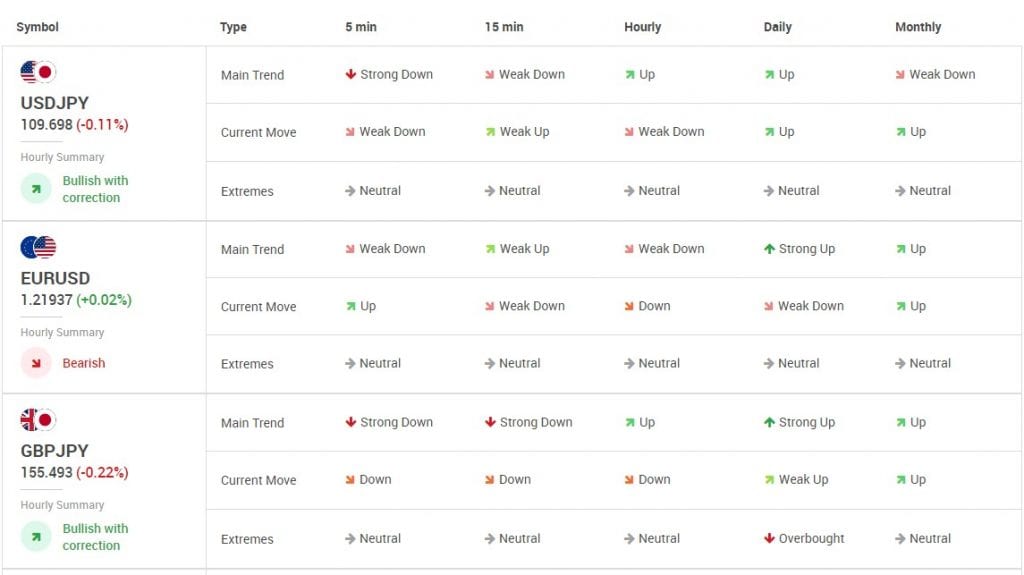

Technical Summaries

The XM Technical summaries provide traders with information regarding 5-min, 15-min, hourly, daily and monthly Main Trend, Current Move and Extremes for various Financial Instruments. It’s really useful for traders that rely on Technical Analysis to perform their trades.

Economic Calendar

XM’s economic calendar can help you keep up to date with the latest news. The Economic Calendar can be filtered according to the currency pair or instrument of your choice or based on the dates that you want to analyze. The XM economic calendar is extremely useful to traders that trade using Fundamental Analysis and fundamental indicators.

XM TV

XM Group’s XM TV delivers excellent daily in-house market videos that even compete with industry leaders’ videos such as Saco, CMC Markets and IG. XM TV is themed in a TV interview-style format. Users can also access the audio of XM TV from the podcast section of the website.

XM Podcast

XM’s podcast, named Global Market Insights, provides traders with top-notch information required to form excellent trading strategies.

Platform Tutorials

As the broker cares for beginner traders as much as advanced traders, they offer the tutorials needed to get you started right away! They have a generous selection of tutorial videos that can help you get started with MT4 and MT5.

Forex Webinars

XM’s Forex Webinars are available in 19 Languages, 7 Days a Week with 67 Webinar Instructors. Users can schedule their participation in the webinars via the website by choosing the language, time and day that suits them best.

Some of the instructors are:

- Avramis Despotis

- Adam Rak

- Andrzej Zieniuk

- Habib Akiki

- Lorenzo Sentino

- Imran Zailani

- Kriengkrai Jermpatjanya

- Lu Huu Duy

- etc

Educational Videos

XM offers a great variety of educational Videos in the following topics:

- Introduction to the markets

- Trading essentials

- Fundamental analysis

- Technical analysis

- Money management

- Trading psychology

- Trading strategies

XM Prepaid Cards

Early last year, 2020, XM presented us with a new solution that was expected by everyone: XM Prepaid Cards

XM USD MasterCard & XM EUR MasterCard & XM USD Shanghai (China Union Pay. Unfortunately, the service has been suspended by XM. It is not new, as it is a general trend by brokers around the world to provide card service to clients, making it easier for them to manage their money, withdraw and deposit processes with ease.

FinTech companies spread in the world and in the European Union are working to restore and provide this service to clients, even if on the scale of Europe. Therefore, we may return again to seeing Prepaid cards available to clients in order to facilitate trading and provide a distinctive experience that will definitely attract many individuals to the trading experience in general.

XM offered its smart cards free of charge to traders with portfolios over $2000. Also, you could only charge them separately for $10. MasterCard is the partner that has always made a kind of success and expansion upon its participation in providing such services, especially due to its reputation, wide spread and strong infrastructure.

All the reasons on the ground that justify what happened to cancel this service is that it is not in agreement with the AML anti-money laundering policy, as you acknowledge that the broker must respect that the withdrawal process is in the same way as the deposit process.

Therefore, the companies suspended the service due to the fact that the financial partner and FinTech are located in the European Union and they are obligated to abide by the policies and laws. However, news remains that an international solution may be on the way, because it is indeed a distinguished experience and must be generalized and codified. We are seeing Bitcoin debit and credit cards now, so soon we hope that these solutions will return.

Customer Support

XM provides its clients with technical support to answer any inquiries you need. Where you can reach technical support by just a phone call, live chat, or browse their blog and the FAQs , where you can find what you want. you can choose your native language to communicate from among the languages supported by XM. This makes it relatively easier to explain what you want.

The service is available 24/5 from Monday to Friday during the global financial markets. The languages available with XM are English, Greek, Japanese, Chinese, Bahasa Malay, Indonesian, Hungarian, Russian, French, Spanish, Italian, German, Polish, Hindi, Arabic, Korean, Portuguese, Czech, Slovak, Bulgarian, Romanian, Dutch.

XM Group Available Countries

XM accepts clients from almost all over the world. Some of the countries that XM doesn’t serve are:

- United States

- Cuba

- Sudan

- Syria

- North Korea

- Canada

- New Zeland

- Iran

- Palestine

- China

- Japan*

*Japan – XM.com doesn’t serve Japan, however, XM serves Japanese forex traders through https://www.xmtrading.com/.

XM Review – Final Thoughts

XM is a safe broker as it is regulated and supervised by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the International Financial Services Commission of Belize (IFSC). In addition to Trading Point MENA Limited, XM legal division, regulated and supervised by (DFSA) the Dubai Financial Services

- The first offer is a 100% deposit bonus, the value is up to $5000. It is worth noting here, that you cannot withdraw any money from this offer, before you trade more than 500 contracts in the first 30 days from the date of depositing funds in your account. Profile.

It is somewhat difficult for a trader who deposits an amount of money to trade successfully in his first 30 days with a value of $ 50 million.

- The second offer from XM is the XM Loyalty Program, where you can win endless cashbacks.