Best Cryptocurrency Exchanges 2023

Introduction

The past half a decade has seen the emergence and mainstream acceptance of cryptocurrencies and altcoins. Although cryptocurrencies were initially designed to settle transactions anonymously, their popularity is largely due to their value as assets. As is with anything of value, people would naturally want to trade them. This is where cryptocurrency exchanges come in. So, what is a cryptocurrency exchange?

A crypto exchange is an online platform where you can buy cryptocurrencies using fiat currencies. Through crypto exchanges, you can also sell your cryptocurrencies to other people or the market. You can also exchange one crypto for another.

How do Cryptocurrency Exchanges Work?

Typically, crypto exchanges function almost the same way as traditional stock or FX exchanges – which means they allow you to buy, sell, or speculate on various cryptocurrencies.

The functionality of crypto exchanges tends to vary depending on the type of exchange. Some exchanges have diversified the services they offer to their clients beyond the normal buying and selling. Some provide custodial services, leverage trading, and offer prepaid debit cards which can be used to withdraw fiat currencies from ATMs.

Why use Crypto Exchanges in 2023?

2020 could very well be considered the golden year for cryptocurrencies. Cryptocurrencies surged in valuation with Bitcoin leading the pack gaining with a gain of over 600%. With the increased adoption of cryptocurrencies and DeFi, the bullish trend observed in 2020 is poised to continue. Cryptocurrency exchanges provide the best platforms for investors seeking a store of value and speculative traders. Here are some of the advantages of using crypto exchanges.

- Lower transaction costs

- Fair pricing

- Reliability – crypto exchanges provide adequate liquidity

- Several coins are made available. This ensures that you can diversify your crypto portfolio as much as you want.

Types of Cryptocurrency Exchanges

- Direct Trading Platforms: These are crypto exchanges that allow direct peer-to-peer trading. That means you or sell cryptos directly to other users on the platform without an intermediary. This allows sellers to establish their exchange rates and buyers to look for sellers who have favourable rates.

- “Traditional” Cryptocurrency Exchanges: These exchanges function similar to the regular stock exchanges. Crypto trade is done based on the prevailing market price with the exchange serving as the intermediary. Such exchanges also allow users to trade in fiat currencies.

- Cryptocurrency Brokers: These are crypto exchanges where users buy and sell cryptos to the brokers at prices set by the brokers. The price is often the market price plus some premium. Such types of exchanges are often the easiest to use, especially for new users.

- Cryptocurrency Funds: are typically used as a form of investment. Crypto funds are a select pool of cryptocurrencies and other crypto assets that are professionally managed. They allow you to buy and hold various cryptocurrencies under a single fund.

Top 5 Crypto Exchanges In 2023

| Crypto Exchange | Rank | Top features |

| Coinbase | 1 |

Over 500 cryptos and altcoins Coinbase insurance Three fiat currencies allowed |

| Kraken | 2 |

Deals with fiat currencies Allows dark pool trading Has OTC markets Seven fiat currencies allowed |

| Binance | 3 |

Highest daily turnover The largest number of cryptos available Fast availability of cryptos after an ICO 15 fiat currencies available |

| eToro | 4 |

Has crypto CFD trading Highly regulated Lowest fees from 0.03% |

| Coinmama | 5 |

Highest fees up to 10.9% Only supports buying Only ten cryptos available |

Best Cryptocurrency Exchanges in 2023

There are hundreds of crypto exchanges available; here is our ranking of the best crypto exchanges in 2022.

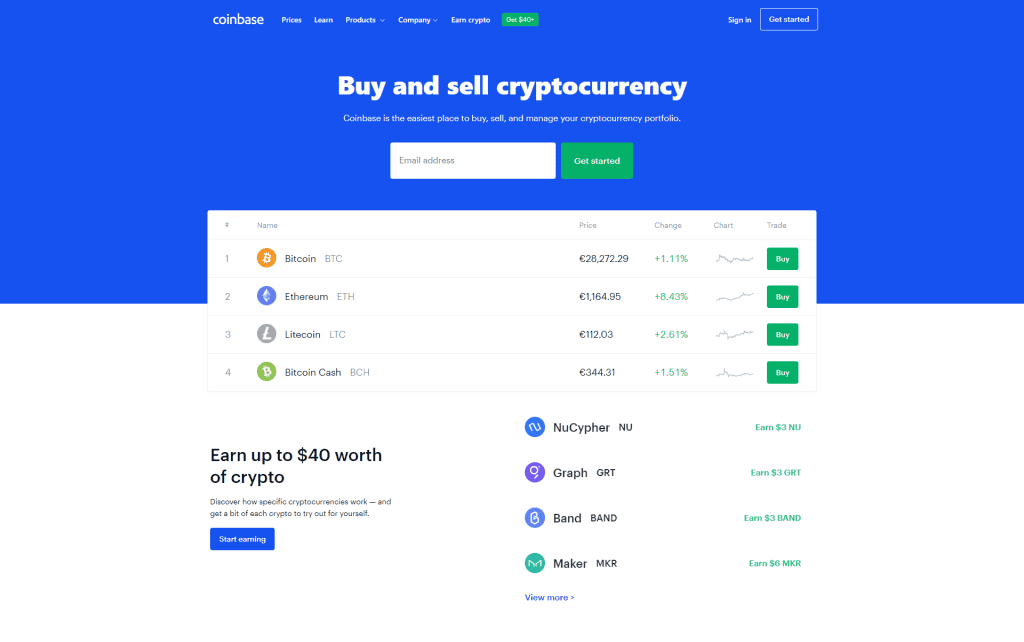

Coinbase Crypto Exchange

Coinbase is one of the most widely used crypto exchange in the world. Headquartered in San Francisco, California, Coinbase was established in 2012, making it one of the oldest crypto exchanges globally. It is operational in over 100 countries, with over 35 million registered users. The services offered by Coinbase include; brokerage services, Coinbase Pro trading services, Coinbase wallet, and merchant solutions.

Coinbase has over 500 cryptos and tokens, but only a handful are tradeable. Here is a list of the tradeable cryptos on Coinbase: REN, ALGO, REP, AAVE, NU, ETC, ATOM, YFI, WBTC, XTZ, GNT, MANA, SNX, BTC, OMG, OXT, LTC, BAL, EOS, XRP, XLM, LINK, LOOM, ZEC, BAT, DNT, DASH, DAI, GRT, and USDC.

Coinbase pros

- It adheres to strict regulations in the US and Europe. It is licensed by states in the US, registered as a Money Services Business with FinCEN, complies with the USA Patriot Act, the Bank Secrecy Act, and registered by the Financial Conduct Authority (FCA).

- Provides users with Coinbase insurance for funds held in Coinbase accounts

- Coinbase stores 98% of clients’ funds in cold storage preventing loss from hacking

- Simple to use. Coinbase has one of the easy-to-use user interfaces for trading, crypto conversion, and sending and receiving cryptos.

- Has over 500 cryptocurrencies and is highly liquid

- Easy to register; it takes under five minutes on average to fully register an account on Coinbase and less than four hours for your documents to be verified.

- It accepts the use of fiat currencies, including EUR, GBP, and USD.

- Coinbase has an instant exchange feature. This allows users to send cryptos directly using fiat currencies

Coinbase cons

- Coinbase charges relatively higher fees compared to other exchanges. It also has a complicated fee structure different for users with Coinbase accounts and Coinbase Pro accounts.

- Coinbase lacks privacy. All user transactions on Coinbase are monitored and reported to relevant authorities

- Coinbase has one of the worst poor customer support services among the top crypto exchanges

- Users have no complete control of their wallet keys

Coinbase fee structure

Coinbase charges 0.5% of the total transaction value when users buy or sell cryptocurrencies. It also attracts deposit and withdrawal fees ranging from 1.49% to 3.99% depending on the payment method. Wire transfers cost $10 to deposit and a withdrawal charge of $25.

Countries where Coinbase is accepted

Coinbase is accepted in the US, Canada, Europe, Africa and the UK. Some of the countries include Romania, Australia, Costa Switzerland, Peru, Colombia, Barbados, India, Honduras, Botswana, Iceland, Singapore, Oman, Trinidad, Canada, Kyrgyzstan, Namibia, Andorra, Kazakhstan, Taiwan, Montenegro, Rica, Slovakia, Angola Denmark, Islands, Tunisia, Benin Bahrain, Man, Marino, Austria, Nicaragua, of Liechtenstein, Bermuda, Jordan, States, Mongolia, Croatia, Greece, Indonesia, Spain, Chile, Rwanda, New Norway, Bahamas, Monaco, Italy, Cyprus and Argentina.

For the complete list of countries where Coinbase services are available, please visit this link.

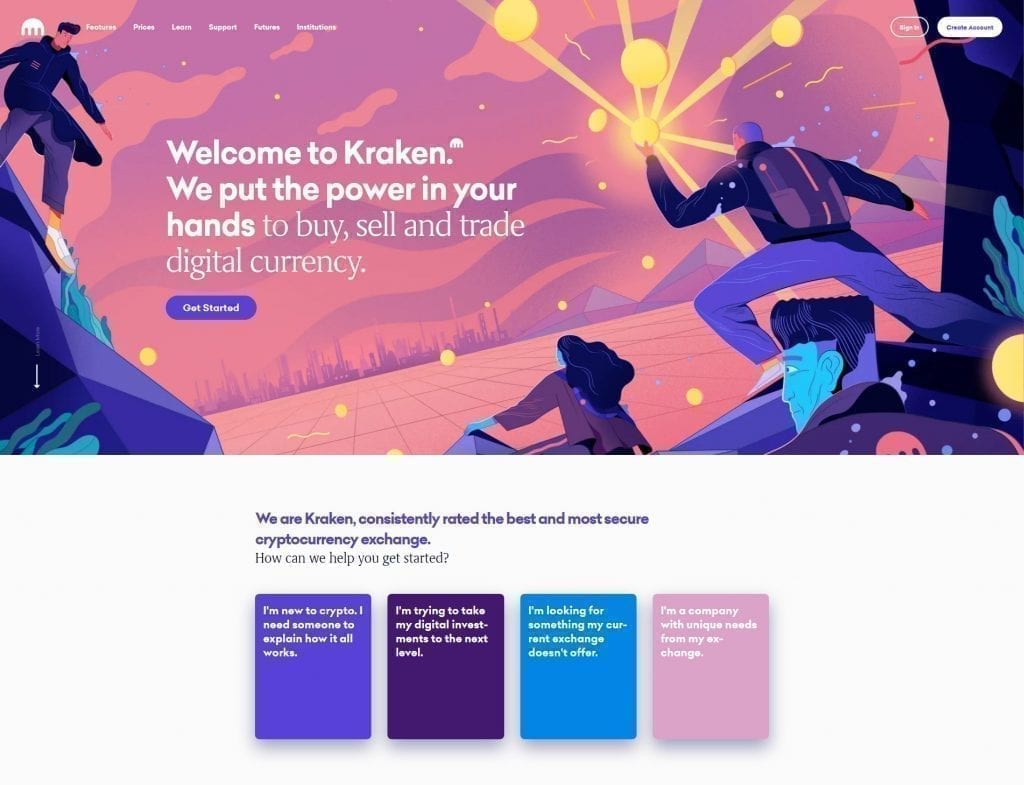

Kraken crypto Exchange

Kraken is headquartered in San Francisco, California. It is one of the largest crypto exchanges in North America and offers margin trading facilities to its users.

Kraken has 38 tradeable cryptocurrencies which include: AAVE, ALGO, ANT, REP, REPV2, BAT, BAL, XBT, BCH, ADA, LINK, COMP, ATOM, CRV, DAI, DASH, MANA, XGD, EOS, ETH, ETC., FIL, GNO, ICX, KAVA, KEEP, KSM, KNC, LSK, LTC, MLN, XMR, NANO, OMG, OXT, PAXG, DOT, QTUM, XRP, SC, XLM, STORJ, SNX, TBTC, USDT, XTZ, GRT, TRX, UNI, USDC, WAVES, YFI, and ZEC.

Kraken Pros

- Allows trading in fiat and crypto pairs. Fiat currency available on Kraken includes; GBP, JPY, EUR, USD, CAD, AUD, and CHF.

- Allows users to trade in dark pools. This gives the option of complete privacy if one wants their transactions to remain off the public records.

- Has low trading fees ranging from 0% to 0.26%. Trading in dark pools attracts higher fees ranging from 0.26% – 0.36%. For stable coins, trading fees range from 0% to 0.2%. The fees charged depend on the 30-day trading volume and are based on a maker-taker system.

- Kraken uses proof-of-reserves audit system to safeguard clients’ funds.

- Offers one of the lowest margin trading fees from as low as 0.01%

- Offers future trading

Kraken cons

- Kraken has a complex trading interface. Although the software has one of the most comprehensive trading parameters, it tends to be complex and confusing, especially for beginner traders.

- Kraken has limited payment options. They include SEPA, SWIFT, bank transfers, and wire transfers.

- The trading platform doesn’t offer users a demo trading option

- It doesn’t provide crypto wallets

- Kraken is not a regulated crypto exchange. It was delisted in New York

- Kraken charges an opening fee of up to 0.02% and a rollover fee of up to 0.02% every four hours.

- It has poor customer support. Most users complaint that they take longer to respond to questions and complaints, and often offer general solutions

Countries where Kraken is accepted

Kraken crypto exchange is operations globally except in these countries: Central African Republic, Eritrea, Guinea-Bissau, Lebanon, Mali, Namibia, Somalia, South Sudan, Sudan Yemen.

Here, you can find the list of countries where Kraken services are not available or partially restricted.

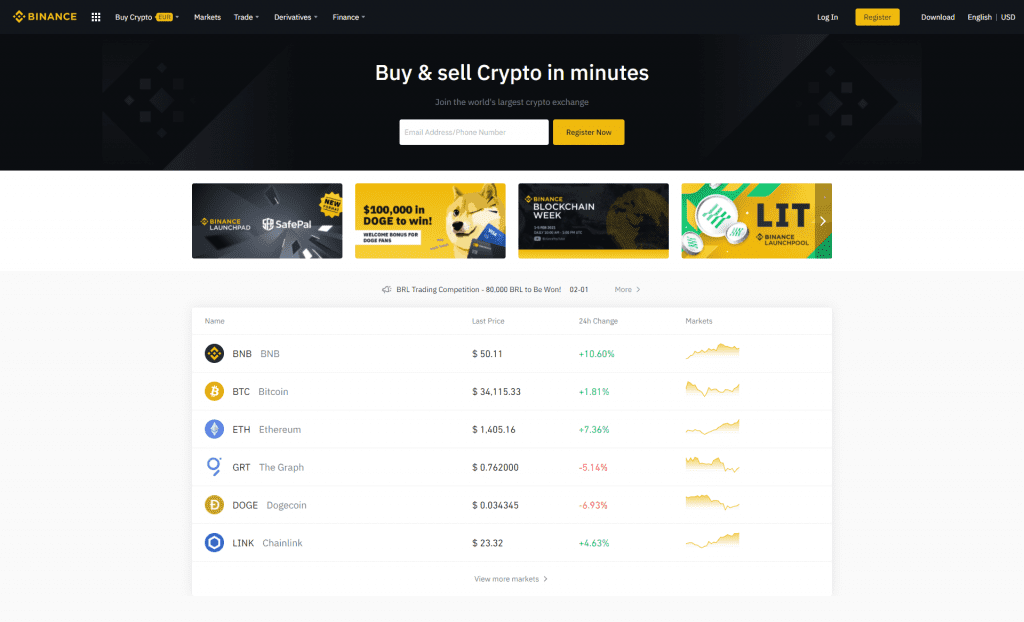

Binance Crypto Exchange

Binance crypto exchange was founded in 2017 and is currently headquartered in Malta. It is one of the fastest-growing crypto exchanges – in early 2018, it experienced exponential growth in customer growth that it had to suspend new registrations for a while.

Binance is one of the most liquid crypto exchanges with an average daily trading volume of over $4 billion. It also supports about 700 cryptocurrencies and tokens.

Binance pros

- It has the highest number of altcoins among the top crypto exchanges. Binance is often quick in listing new cryptos as soon as they complete the ICO – which is why it is the most popular crypto exchange.

- Binance supports the largest number of fiat currencies among crypto platforms. The 15 currencies are; the United Arab Emirates Dirham (AED), Australian Dollar (AUD), Canadian Dollar (CAD), Swiss Franc (CHF), Czech Koruna (CZK), Euros (EUR), British Pound (GBP), Hong Kong Dollar (HKD), Danish Krone (DKK), Hungarian Forint (HUF), Mexican Peso (MXN), Norwegian Krone (NOK), New Zealand Dollar (NZD), Polish Zloty (PLN), and Swedish Krona (SEK)

- It allows for futures/ options contract trading on its platforms. It has both perpetual and quarterly futures

- Binance has an OTC trading platform which guarantees to trade large volumes of cryptos without the risk of slippage. The minimum trade on this platform is the equivalent of 10,000 USDT. Over 25 cryptos are available on the Binance OTC platform.

- T has a lending platform called Binance Lending Products. This feature allows users to deposits cryptos into their accounts and ‘lock’ then in for a specific period, during which they will earn some interest.

- Binance has the lowest fees among the top crypto exchanges – a standard trading fee of 0.1% for both makers and takers. Traders can reduce the fees by up to 25% by using Binance native crypto BNB.

- Binance is one of the most secure platforms. Its website uses the Cryptocurrency Security Standard (CCSS) – this is an industry-standard security feature for major crypto exchanges.

- Binance issues Binance Card which works the same way as a normal prepaid debit card. It allows you to transact using your crypto holdings

- Binance is a regulated crypto exchange in Malta under the Virtual Financial Assets (VFA) act.

- Binance has a Secure Asset Fund for Users (SAFU), a reserve fund if it is ever hacked. SAFU is funded by 10% of all trading fees generated from the Binance platform.

Binance Cons

- Binance was designed for advanced users. It has a complicated and comprehensive charting system and trading features

- Although it has the most cryptos, it has fewer tradeable pairs compared to other crypto exchanges

- Binance has a comprehensive KYC compliance which is a disadvantage for users who might prefer anonymity

- Demo trading account is only available for futures trading

- It is not widely accepted throughout the US. 13 US states have banned Binance.

Countries where Binance is accepted

Binance is accepted in over 198 countries worldwide except in a few US states (Alaska, Connecticut, Hawaii, Idaho, Louisiana, New York, North Carolina, Texas, Vermont, Washington) and these countries: Belarus, Syria, African Yemen, Sudan, Kosovo, North Central Croatia, Zimbabwe. Albania, Korea, Cuba, Iran, Liberia, Herzegovina, Somalia, Venezuela, D’Ivoire, Sudan, South Côte Lebanon, Republic, Bosnia, Burma, Ukraine, and Syria.

For the complete list of 198 countries, please visit this link.

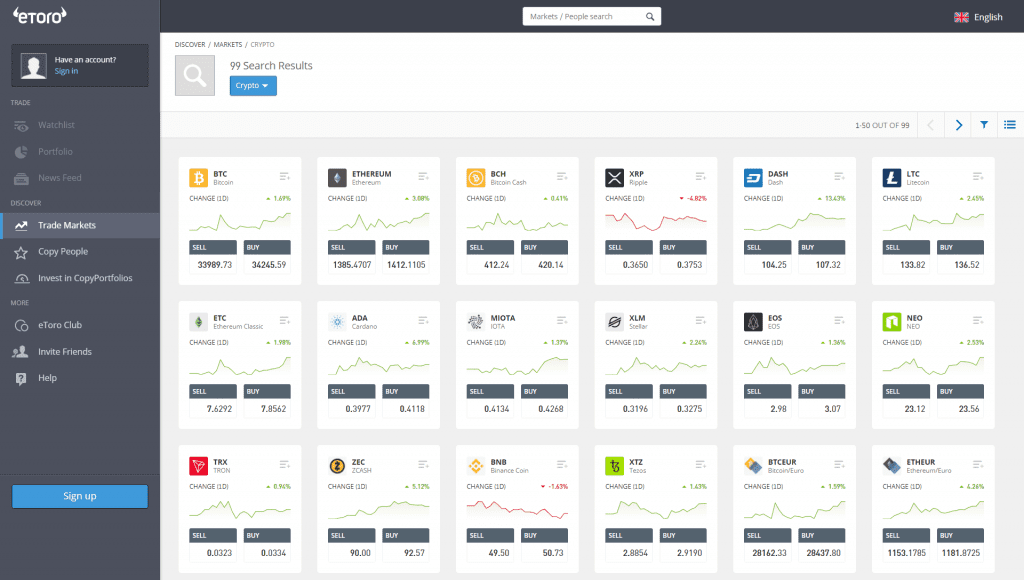

eToro Crypto Exchange

Based in Israel, eToro is a brokerage company established in 2007 and is considered the world’s leading social trading platform. Although eToro was initially designed as a CFD trading platform, it has evolved to offer crypto exchange services. eToro began offering crypto trading in 2016 and crypto exchange services in 2018 for US-based clients.

It is one of the most regulated crypto exchanges in the world. It is regulated by the Cyprus Securities & Exchange Commission (CySEC), Financial Conduct Authority (FCA) in the UK, the Australian Securities and Investments Commission (ASIC), and regulated under the Corporations Act (Commonwealth).

eToro Pros

- eToro is among the few crypto exchanges which offer CFD trading. This is advantageous for speculative traders who intend to profit from cryptos’ volatility without owning the actual cryptocurrencies.

- As a social trading platform, eToro users get to enjoy copy-trading features at no cost. For new traders, it becomes easier to profit from the markets by following trading activities of pro traders

- eToro user interface is one of the easiest and friendliest to navigate. New users easily catch on

- eToro has an eToroX platform which allows users to store and transfer cryptocurrencies securely.

- It has eToro Crypto Wallet which supports over 120 selected cryptos

- eToro offers tight spreads and competitive fees. There are no fees for depositing cryptos and trading fees are as low as 0.03%. The maker and taker fees range from 0.03% to 0.24% depending on the volume traded. It attracts 0.1% fees for crypto to crypto conversion, and 1% for fiat to crypto conversion.

eToro cons

- The eToroX platforms is a fairly new crypto exchange and still growing its users

- Since eToro is a fully regulated broker, it has very strict KYC verification which robs crypto users of anonymity

- It cannot legally provide crypto trading services in 191 countries – the most among crypto exchanges.

Countries where eToro is accepted

Due to regulatory challenges, eToro cannot offer its services in about 191 countries. Here’s the list. Although eToro is available in the US, it doesn’t provide services to US citizens living outside the US.

Coinmama Crypto Exchange

Coinmama is an Israeli-based crypto exchange created in 2013. Coinmama is primarily a crypto exchange broker. This means that it holds cryptos and sells it to the users for fiat or other cryptos.

Coinmama pros

- With Coinmama, users can easily purchase cryptos using fiat currencies directly from their debit or credit cards or bank deposits. It’s as easy and simple, like shopping online.

- Instant exchange. Once you make your purchase, Coinmama sends you the cryptos directly and instantly to your private crypto wallet. This gives you complete control of your crypto wallet keys.

- It has a user-friendly interface. Unlike most exchanges designed for advanced traders, Coinmama has a simple user interface that allows a user without any prior knowledge of crypto trading to purchase cryptos with ease.

- Coinmama is one of the most secure crypto exchanges and is registered with FINCEN in the U.S

Coinmama cons

- Coinmama has very high fees compared to other crypto exchanges. Users are charged a 5% fee for depositing funds in their Coinmama accounts and another 5.9% Coinmama brokerage fees for buying cryptos. In total, users incur an extra charge of 10.9% of their transacted volume.

- Coinmama only supports buying cryptos. Users cannot trade their cryptos on Coinmama. This is disadvantageous compared to other crypto exchanges which offer several services to users.

- Coinmama imposes buying limits depending on your account level. The minimum amount any user can buy is $60.

- Coinmama has very few cryptos available to users. The only ten supported cryptocurrencies are BTC, ETH, XRP, LTC, BCH, ADA, QTUM, ETC., EOS, and XTZ.

Countries where Coinmama is accepted

Coinmama is accepted in over 188 countries, including the US. However, it is restricted in some US territories like American Samoa, Guam, Northern Mariana Islands, Puerto Rico, United States Minor Outlying Islands, and the Virgin Islands. It is also restricted in Hawaii and New York.

Countries, where Coinmama is banned, include; Cuba, Crimea, Iran, Israel, Lebanon, North Korea, Palestinian Territories, South Sudan, Sudan, and Syria.

How to Choose a Cryptocurrency Exchange

Here are the most crucial factors to consider when choosing a crypto exchange when you embark on your crypto trading journey.

- Ensure that the crypto exchange legally offers services in your country. This will prevent you from having your funds frozen or avoid any complications in crypto trading

- Ensure that the crypto exchange is registered and regulated by a reputable financial authority. Although it is not uncommon to find crypto exchanges that are not regulated, some of the best ones are registered or regulated by at least one authority in their domicile country

- Consider the number of cryptos and assets available. Be sure to select crypto exchanges that expose you to several cryptocurrencies, altcoins, and tradeable assets. Since cryptos tend to be volatile, the availability of several options help you to diversify your portfolio

- The customer support team’s competence and availability – you wouldn’t want to have an account in an exchange where the customer support is incompetent or rarely available round the clock.

- The total trading fees charged by the exchange – this is perhaps the most important factor to consider. The trading fees you incur when trading cryptos impact your overall profitability. Some exchanges may have lower trading fees but have higher deposit and withdrawal fees. Be sure to check and aggregate the total fees incurred

Cryptocurrency Exchanges FAQs

Must crypto exchanges be regulated?

No. Crypto exchanges don’t need to be regulated. But they must be registered in countries where they are domiciled. However, we recommend trading with exchanges that are fully regulated by a recognized body.

Are all crypto exchanges decentralized?

No. some exchanges are centralized while others are decentralized.

What is a decentralized crypto exchange (DEX)?

This is a crypto exchange where users trade directly, and cryptos are transferred directly to their private wallets. No intermediary holds customer funds. However, such exchanges suffer from low liquidity.

What is a centralized exchange?

These are exchanges which accept and hold clients’ funds in its accounts. The exchanges match buyers and sellers. Such exchanges have rigorous KYC policies and anti-money laundering (AML) rules.

Do crypto exchanges allow transfers to private wallets?

Not all crypto exchanges allow users to transfer their portfolio to private wallets. Such exchanges serve as custodial for your cryptos. Other exchanges allow you to transfer your cryptos to private wallets, giving you complete control over your private keys.

We hope you find this article informative. If you have any questions, please let me know in the comments below. Cheers!

Top Crypto Exchanges 2022

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.